CM Punjab Asan Karobar & Asan Card Scheme | Key Features, Eligibility Criteria, and Complete Registration Process

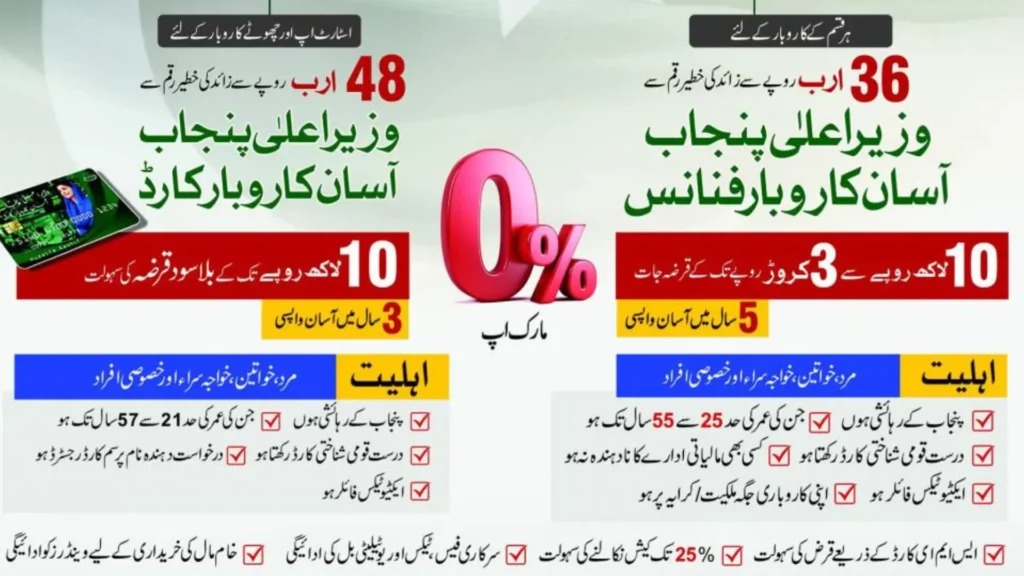

In an effort to provide financial relief and empowerment to small business owners and traders in Punjab, the Punjab government, under the leadership of the Chief Minister Punjab, has launched two revolutionary financial schemes under the CM Punjab Loan Scheme:

(1) CM Punjab Asan Karobar Finance

(2) CM Punjab Asan karobar Card

These initiatives aim to provide accessible financial resources to promote entrepreneurship and help businesses grow. Before this, the solarization program is also being launched and the Ramadan Nigahban package is also under consideration. Let us find out in detail the terms and conditions of availing of these loan schemes and the procedure for applying.

Introduction to the CM Punjab Loan Schemes

The CM Punjab loan schemes are part of the provincial government’s ongoing efforts to boost the local economy by enabling individuals to establish and expand businesses. These programs are specifically designed for the self-employed, farmers, and small business owners who are struggling to access traditional financial resources.

The loans offered under these schemes come with favorable terms, including low interest rates and flexible repayment options, making them an excellent opportunity for business growth.

CM Punjab Assaan Karobar Finance

The CM Punjab Assaan Karobar Finance is a flagship loan program that provides interest-free loans to all kinds of business owners. This scheme aims to provide financial assistance to individuals who want to start a business or expand an existing business.

Key Features Of CM Punjab Assaan Karobar Finance

Loan amount: Rs 1 million to Rs 30 million(10 Lakh to 03 karor).

Interest Rate: 0% interest rate

Repayment Term: Easy return in five (5) years.

Eligibility Criteria Of Assaan Karobar Finance

- Male, Female, Transgender, and Special Persons

- Resident of Punjab

- Age: 25 to 55 years

- Having an identity card

- Not a defaulter of any financial institution

- Be an active tax filer

- Have a place of residence (personal/rented)

Registration Process: How to Apply for the CM Punjab Loan Scheme

The application process for the CM Punjab Assaan Karobar Finance is designed to be simple and user-friendly. Here’s how you can apply:

Visit the Official Portal: The registration process begins by visiting the official website of Assaan Karobar Finance (akf.punjab.gov.pk)

Fill Out the Application Form: Applicants need to complete an online form with personal and business details. This includes submitting documents such as a CNIC (Computerized National Identity Card), proof of business activity, and income statements.

Submit Documentation: Ensure that all required documents are uploaded in the correct format to avoid delays in processing your application.

Loan Approval Process: After submission, your application will be reviewed, and upon approval, the loan amount will be disbursed.

CM Punjab Assaan Karobar Card

The CM Punjab Assaan Karobar Card (Easy Business Card) is another groundbreaking initiative. This program provides interest-free loans to small business owners. With a focus on accessibility, the scheme aims to give financial independence to individuals who wish to start or scale their businesses.

Assaan Karobar Card serves as an easy-to-access financial tool that simplifies the process of borrowing and repayment. Individuals can use it to access financial services, manage loans, and even facilitate business transactions.

The card aims to ensure transparency and convenience for users, thus reducing paperwork and minimizing administrative delays. The card is linked directly to the loan facility, ensuring that funds are easily available when required.

Key Features Of CM Punjab Assaan Karobar Card

- Loan amount: up to Rs. 10 lac

- Interest Rate: 0% interest rate

- Repayment Term: Easy return in three (3) years

Eligibility Criteria for CM Punjab Assaan Karobar Card

To ensure the resources are directed to the deserving individuals, certain eligibility criteria must be met:

- Male, Female, Transgender, and Special Persons

- Resident of Punjab

- Age: 21 to 57 years

- Having an identity card

- SIM card registered in the name of the applicant

- Be an active tax filer

How to Apply for the CM Punjab Loan Scheme

The application process for the Assaan Karobar Card is designed to be simple and user-friendly. Here’s how you can apply:

Visit the Official Portal: Visit the official website of Assaan Karobar Card (akc.punjab.gov.pk).

Fill Out the Application Form: Complete the online form with personal and business details.

Submit Documentation: Ensure that all required documents are uploaded in the correct format to avoid delays in processing your application.

Loan Approval Process: After submission, your application will be reviewed, and upon approval, the loan amount will be disbursed. The CM Punjab Assaan Karobar Card will also be issued to you, providing easy access to your funds.

Conclusion

The CM Punjab Loan Scheme, along with the CM Punjab Assaan Karobar Finance and the CM Punjab Assaan Karobar Card, provides an exceptional opportunity for aspiring entrepreneurs in Punjab. These initiatives focus on making financial resources more accessible to those who need them most—empowering local businesses to thrive and grow. By offering zero-interest loans and simplifying the application process, CM Punjab’s leadership is creating an environment where businesses can flourish and contribute to the economic growth of the region.

So, whether you are a small business owner looking to expand or a new entrepreneur just starting, the CM Punjab loan schemes provide the support you need to succeed. Don’t miss out on these incredible opportunities to build and grow your business in Punjab!